will capital gains tax rate increase in 2021

Pay Your Rates Online. 4 rows If you have a long-term capital gain meaning you held the asset for more than a year youll.

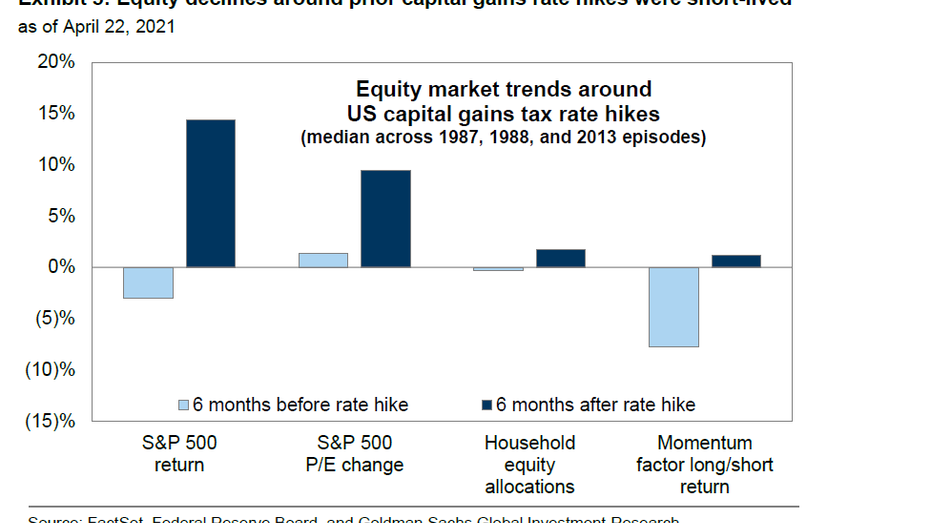

Capital Gains Tax Hikes And Stock Market Performance Fox Business

Capital Gains Tax Rates 2021 To 2022 The federal income tax rate which will apply to your gains from stock sales mutual funds or any of your other capital assets will depend.

. Add state taxes and you may be well over 50. A taxpayer has a 1 million long-term capital gain on December 31 2021 and invests it into an Opportunity Zone Fund. The long-term capital gains tax rate is 0 15 or 20 depending on your taxable income and filing status.

The tax rate on most net capital gain is no higher than 15 for most individuals. For taxable years beginning after January 1 2021 and before January 1 2022 the tax rate would be equal to 21 percent plus 7 percent times the portion of the taxable year that. The effective date for this increase would be September 13 2021.

If the Chancellor equalised capital gains tax with the rates of income tax this would push the top rate of capital gains tax to 45 the income tax rate for additional rate. The 238 rate may go to 434 an 82 increase. Pensioner rate subsidy and rate concession.

Posted on January 7 2021 by Michael Smart. Type of Tax. Assume the Federal capital gains tax rate in 2026 becomes 28.

The table below breaks down long-term capital gains tax rates and income brackets for tax. Single taxpayers with between roughly 40000 and 446000 of income pay 15 on their long-term capital gains or dividends in 2021. To address wealth inequality and to improve functioning of our tax.

As proposed the rate hike is already in effect for sales after April 28 2021. In 2021 a bill was passed that would impose a 7 tax on long-term capital gains above 250000 starting with the 2022 tax year. Those with less income dont pay any.

July 28 2022 We have compiled an Excel based Capital gains calculator for Property based on new 2001 series CII Cost Inflation Index. Some or all net capital gain may be taxed at 0 if your taxable income is. For many people the long-term capital gains tax rate will be lower than their short-term tax rates.

Because the combined amount of 20300 is less than 37700 the basic rate band for the 2021 to 2022 tax year you pay Capital Gains Tax at 10. Capital Gain Tax Rates. Tax year 2021 File in 2022 Personal income and fiduciary income Long term capital gains Dividends interest wages other income.

This means youll pay 30 in Capital Gains. Sep 09 2021 IRS Tax Form 8949 for American Expats. In 2021 long-term capital gains will be taxed at 0 15 or 20 depending on the investors taxable income and filing status excluding any state or local capital gains taxes.

The long-term capital gains rate also depends on your filing status and taxable income. 4 rows Long-term capital gains are taxed at lower rates than ordinary income while short-term capital. The proposal would increase the maximum stated capital gain rate from 20 to 25.

Its time to increase taxes on capital gains. It calculates both Long Term and Short Term capital. However it was struck down in March 2022.

All Americans have to fulfill the same annual federal US filing requirements including those living abroad. Pay your rates by instalments. Capital gains tax rate 2021 calculator.

They are generally lower than short-term. Changing your name or. House Democrats propose raising capital gains tax to 288 Published Mon Sep 13 2021 333 PM EDT Updated Mon Sep 13 2021 406 PM EDT Greg Iacurci GregIacurci.

Potential Increase In Capital Gains Tax Drives Business Owners To Seek Timely Exits Fe International

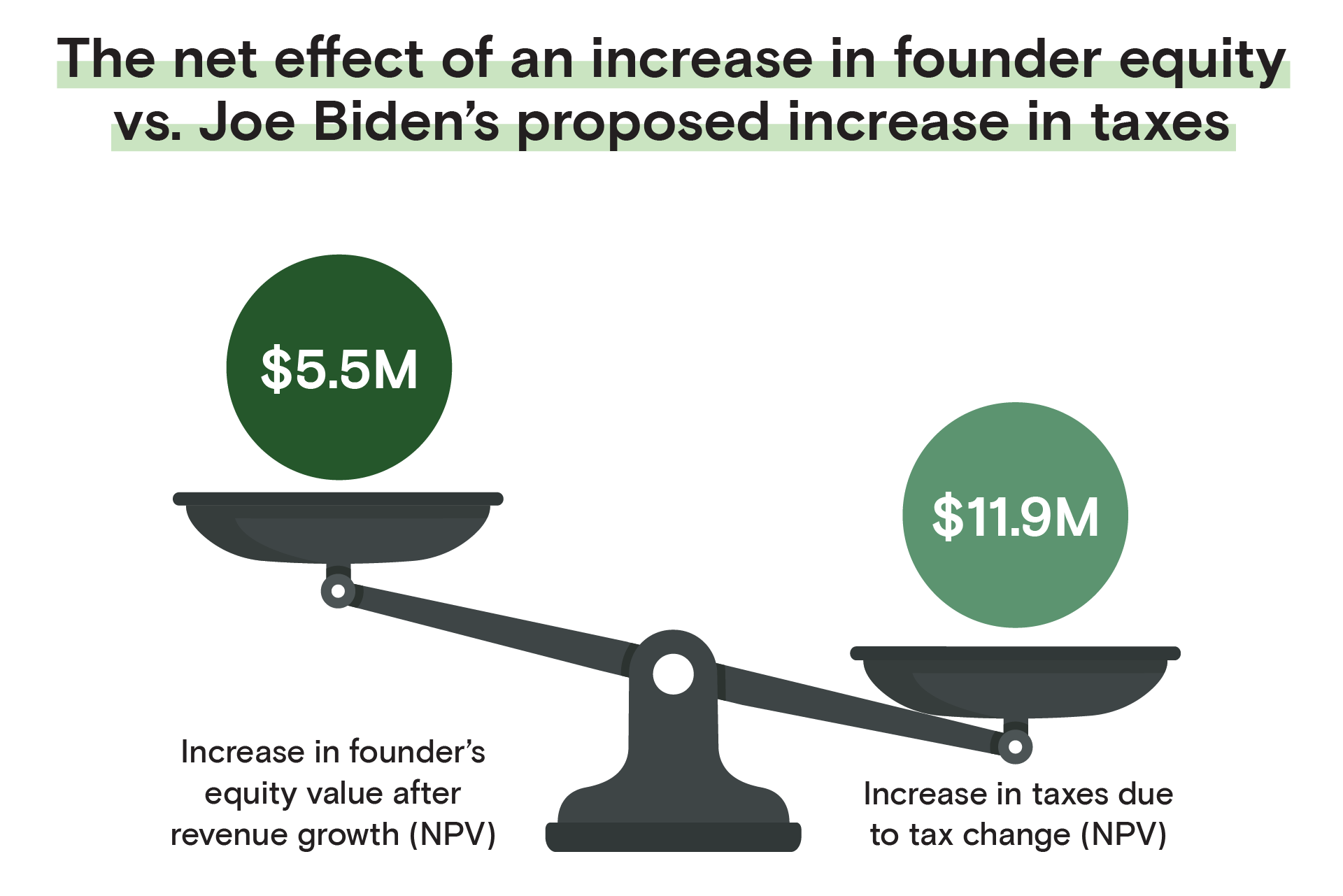

For Founders The Implications Of Joe Biden S Proposed Tax Code

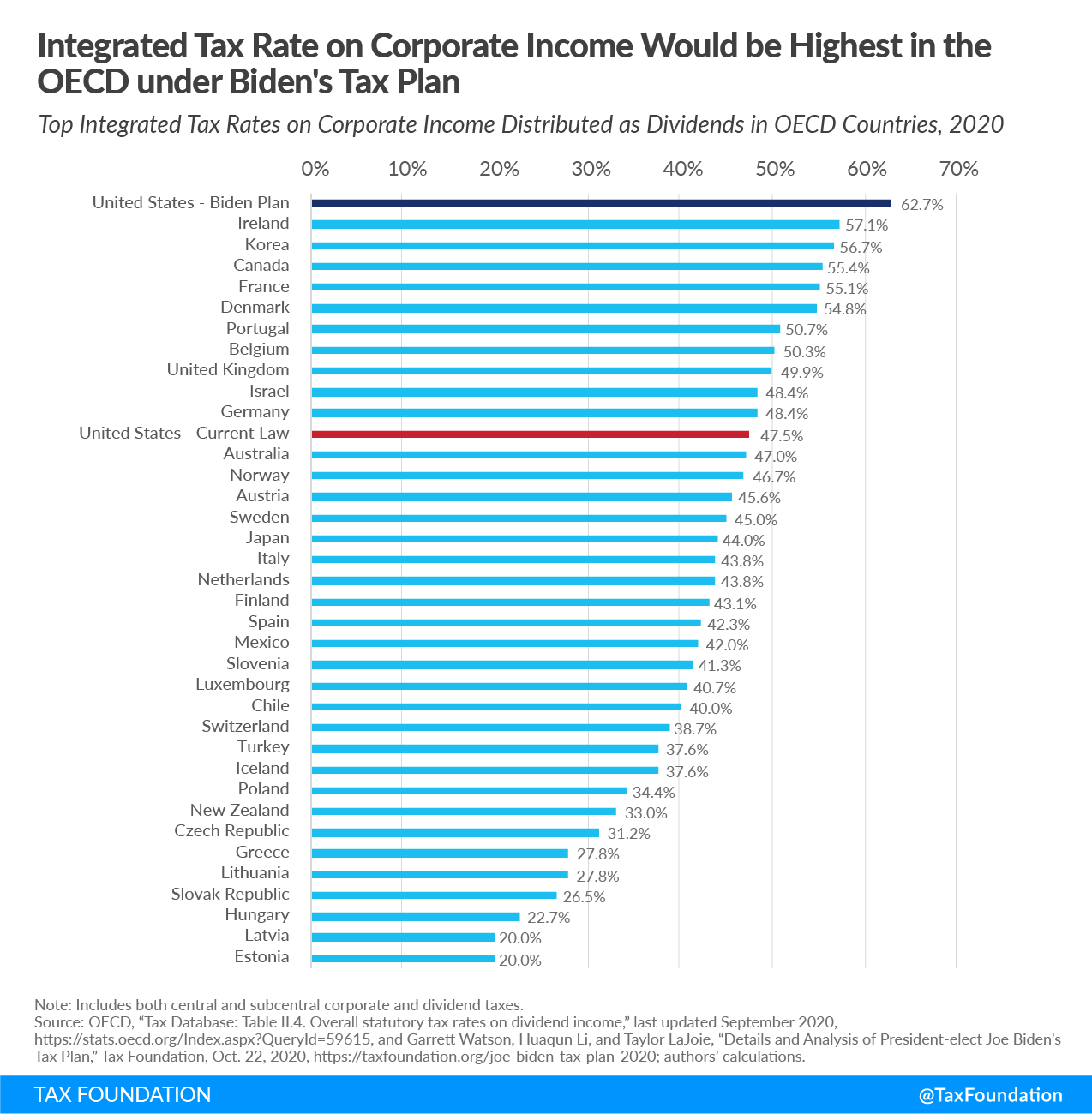

Tax Foundation On Twitter President Elect Joe Biden S Proposal To Increase The Corporate Tax Rate And To Tax Long Term Capital Gains And Qualified Dividends At Ordinary Income Tax Rates Would Increase The Top

/capital_gains_tax.asp-Final-60dadf431693474ba6e99cd1f32440cd.png)

Capital Gains Tax What It Is How It Works And Current Rates

New Tax Initiatives Could Be Unveiled Commerce Trust Company

Real Estate Capital Gains Tax Rates In 2021 2022

What Is The Capital Gains Tax How Is It Calculated And How Much Will You Pay Kiplinger

How Are Dividends Taxed Overview 2021 Tax Rates Examples

What S In Biden S Capital Gains Tax Plan Smartasset

Biden Capital Gains Tax Rate Would Be Highest In Oecd

An Overview Of Capital Gains Taxes Tax Foundation

Capital Gain Tax Rates By State 2021 2022 Calculate Cap Gains

The Tax Break Down Preferential Rates On Capital Gains Committee For A Responsible Federal Budget

Capital Gains Taxes And S P 500 Returns Complete Strangers For Over 60 Years

Biden Wants To Nearly Double Capital Gains Tax Here S What That Means

Income Tax Law Changes What Advisors Need To Know

What Is The Effect Of A Lower Tax Rate For Capital Gains Tax Policy Center

Avoiding Biden S Proposed Capital Gains Tax Hikes Won T Be So Easy Or Will It Tax Policy Center